New Jersey businesses utilize their vehicles for many tasks. From transporting goods to meeting clients, a commercial vehicle is often critical. However, accidents can occur, causing significant damage and monetary losses. That's why it's important for NJ businesses to secure comprehensive commercial auto insurance.

This type of insurance provides financial protection against liability for bodily injury or property damage attributable to a commercial vehicle.

It also includes its autos against harm from accidents, theft, and other hazards. By acquiring commercial auto insurance, you can preserve your business from financial ruin in case of an incident.

- Consult with an insurance agent to determine your specific needs and obtain the right coverage for your business.

- Analyze quotes from multiple insurance providers to find the most favorable rates and coverage options.

Navigating Commercial Insurance Options in New Jersey

Finding the ideal commercial insurance policy in New Jersey can be a daunting task. With various coverage options available, it's essential to meticulously consider your specific business needs and risk profile. First, you should determine the types of coverage that are most for your industry, such as general liability, property damage, professional liability, or workers' compensation.

It is recommended to reach out an experienced insurance broker who owns in-depth expertise of the New Jersey market. A capable broker can guide you through the acquisition process, evaluating different policies from reputable insurers to confirm you obtain the best protection at a competitive price. Remember that your insurance needs may change over time, so it's important to consistently re-evaluate your policy and make changes as necessary.

Liability Insurance

Operating a business in New Jersey comes with inherent challenges. From customer claims to employee incidents, unforeseen circumstances can quickly become costly. That's where liability insurance steps in, providing a crucial financial buffer to safeguard your business assets and standing.

- Regardless the size of your operation, liability insurance is an essential protection. It helps cover legal expenses associated with claims, ensuring you can handle these situations effectively without jeopardizing your financial stability.

- Furthermore, liability insurance demonstrates your commitment to responsibility, building trust with customers, employees, and vendors alike.

Don't leave your business vulnerable to the unpredictable. Secure liability insurance today and enjoy the peace of mind knowing you have a robust protection plan in place.

Protect Your Fleet: Commercial Auto Insurance Solutions

Running a commercial fleet involves unique risks. From accidents to theft and damage, your vehicles are constantly vulnerable. That's why it's crucial to implement robust commercial auto insurance coverage that meets your specific needs. A comprehensive policy will shield you from financial losses in the event of an unforeseen incident.

With specialized coverage tailored for fleets, you can ensure protection for your drivers, vehicles, and cargo. Explore options like liability coverage, collision coverage, and cargo|coverage to create a safety net that reduces risk.

- Partner with an experienced insurance provider who focuses in commercial auto solutions. They can evaluate your fleet's unique needs and develop a customized policy that offers the right level of coverage.

- Continue informed about industry best practices for risk management. Adopt safe driving policies and offer regular driver training to reduce the chance of accidents.

Customized Protection : Commercial Auto Insurance for NJ Businesses

Running a business in New Jersey necessitates meticulous planning, and that includes securing the right insurance for your commercial auto assets. Commercial auto insurance isn't one-size-fits-all. A skilled broker will assess your individual circumstances to craft a plan that protects your commercial interests.

Furthermore the statutory coverage, consider including options like goods in transit coverage for comprehensive assurance. Remember, a well-tailored commercial auto policy can mitigate here your financial liability should an accident occur.

Protection for Commercial Vehicles: Comprehensive Coverage in NJ

Operating a business vehicle in New Jersey requires specialized insurance protection. A comprehensive policy shields your resources from potential financial liabilities arising from mishaps. Choosing the right coverage is vital to minimize risk and provide business stability.

- Discover different policy options, including coverage for {bodilydamage, property damage, and even cargo.

- Consult an experienced insurance representative who specializes in commercial transportation coverage.

- Review your company's specific needs to determine the optimal level of coverage.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Tia Carrere Then & Now!

Tia Carrere Then & Now! Gia Lopez Then & Now!

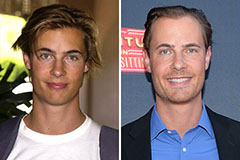

Gia Lopez Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!